L3Harris Technologies is a global aerospace and defense technology innovator, delivering end-to-end solutions. Co.'s reportable segments are: Integrated Mission Systems, which is comprised of intelligence, surveillance and reconnaissance, Maritime and Electro Optical; Space and Airborne Systems, which is comprised of Space, Intel and Cyber, Avionics and Electronic Warfare; Communication Systems, which is comprised of Tactical Communications, Broadband Communications, Integrated Vision Solutions, Public Safety and Global Communications; and Aviation Systems, which is comprised of Mission Networks, Defense Aviation, Commercial Aviation Products and Commercial Pilot Training.

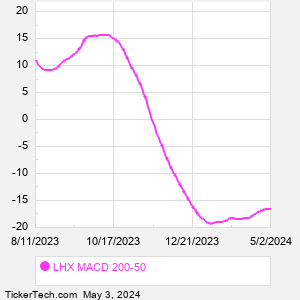

When researching a stock like L3Harris Technologies, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from LHX Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for LHX stock — the real life supply and demand for the stock over time — and examines that data in different ways. One of those ways is to calculate a Simpe Moving Average ("SMA") by looking back a certain number of days. One of the most popular "longer look-backs" is the LHX 200 day moving average ("LHX 200 DMA"), while one of the most popular "shorter look-backs" is the LHX 50 day moving average ("LHX 50 DMA"). A chart showing both of these popular moving averages is shown on this page for L3Harris Technologies. Comparing two moving averages against each other can be a useful visualization tool: by calculating the difference between the LHX 200 DMA and the LHX 50 DMA, we get a moving average convergence divergence indicator ("LHX MACD"). The LHX MACD chart, in conjunction with the chart of the moving averages, basically helps in visualizing how the moving averages are showing convergence (moving closer together), or divergence (moving farther apart). |