Bristol-Myers Squibb is engaged in the discovery, development, licensing, manufacturing, marketing, distribution and sale of biopharmaceutical products on a global basis. Co.'s pharmaceutical products include chemically-synthesized or small molecule drugs, products produced from biological processes, called biologics and chimeric antigen receptor T-cell therapies. Co.'s primary product includes Eliquis® - Eliquis (apixaban), which is an oral Factor Xa inhibitor indicated for the reduction in risk of stroke/systemic embolism in non-valvular atrial fibrillation and for the treatment of DVT/PE and reduction in risk of recurrence following initial therapy.

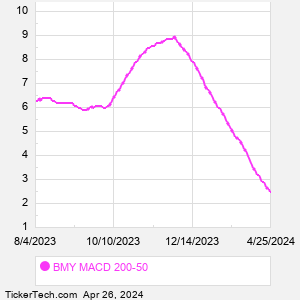

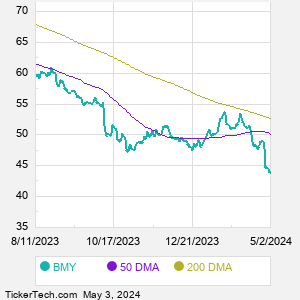

When researching a stock like Bristol-Myers Squibb, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from BMY Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for BMY stock — the real life supply and demand for the stock over time — and examines that data in different ways. One of those ways is to calculate a Simpe Moving Average ("SMA") by looking back a certain number of days. One of the most popular "longer look-backs" is the BMY 200 day moving average ("BMY 200 DMA"), while one of the most popular "shorter look-backs" is the BMY 50 day moving average ("BMY 50 DMA"). A chart showing both of these popular moving averages is shown on this page for Bristol-Myers Squibb. Comparing two moving averages against each other can be a useful visualization tool: by calculating the difference between the BMY 200 DMA and the BMY 50 DMA, we get a moving average convergence divergence indicator ("BMY MACD"). The BMY MACD chart, in conjunction with the chart of the moving averages, basically helps in visualizing how the moving averages are showing convergence (moving closer together), or divergence (moving farther apart). |